LATEST NEWS

INSIGHT, WHITE PAPERS & LATEST RESEARCH

EDITORS PICKS

MORE NEWS

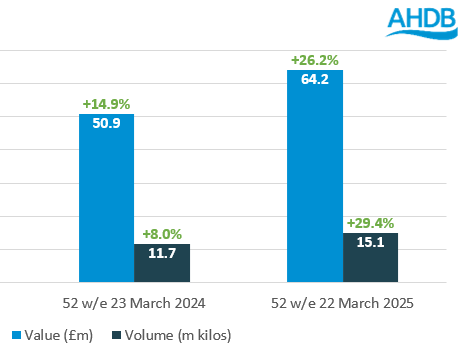

Premium products boost demand for cheese and yogurt

The British dairy market is experiencing change, shaped by evolving consumer preferences and a growing demand for products that deliver quality and versatility.

Creating the future of dairy: Arla Foods and DMK Group announce intention to merge

Arla Foods and DMK Group are proud to announce our intention to merge, creating the strongest dairy cooperative in Europe.

The British cheese the French can’t get enough of – and it’s not Stilton or cheddar

Shropshire Blue has been seen in shops in Paris, Malaga and Porto - and has been spotted at a wine bar in São Paulo.

Discover the FIVE Must - Know Cheese Trends for 2025

Dairy Farmers of Wisconsin Uncovers Key Insights in Trends Report, Offering a Fresh Look at the Evolving Cheese Landscape.

Consumers demand natural, high protein dairy products

Over the last 52 weeks, the dairy sector experienced modest value growth of +2.0%, despite a slight decline in volume (-0.5%).

Dairy milk, once maligned, is making a comeback

Dairy milk has come a long way since the "Got milk?" TV ad campaign more than 30 years ago.

The shape of things to come: Global dairy markets

We look at production, consumption and trade developments across major dairy-producing regions.

AI Boosts Dairy Contamination Detection

New technology can detect eight different pathogenic and spoilage bacteria in milk in just two hours with more than 98% accuracy.

MARKETING & ADVERTISING